"The only things certain in life are death and taxes." - Benjamin Franklin

"The hardest thing in the world to understand is the income tax." -- attributed to Albert Einstein

So as to the first quote, while death is certain in this life, the how & when are fortunately a bit sketchy for most people. You have some control as to your risk seeking behavior, i.e. how much pork belly you consume, if you limit your smoking habit to one pack a day as opposed to two, if you enjoy base jumping in your spare time (if you are not familiar with base jumping, do your life expectancy a favor and pass on Googling this one). Regardless of how or when it comes, it will certainly come eventually.

The how and when of tax day, on the other hand, are certain and stand at April 15th (alright, alright, alright, you are correct, occasionally this is a Saturday or Sunday so it technically could fall on the 16th, 17th, or 18th, but you get what I am saying here). Now one could say that filing an extension is an option to try and finagle your way around the infamous April 15th deadline, but regardless of whether you file for the extension, if you owe, the money is due on April 15th. That is of course unless interest and penalties are your cup of tea.

The second quote, however is the one that boggles my mind. While technically this quote is only attributed to Albert Einstein, let's apply some suspension of disbelief, for my sake, and say that he indeed did say this. Assuming this is the case, what chance in hell do I have of trying to understand the income tax code in 2014 when Einstein couldn't understand it in the 1950s?! Here's the kicker, it is likely that not a single human being on the planet understands the ENTIRE United States tax code. Is it just me, or does this bother anyone else?

Fortunately, I have Turbo Tax. The complexity of the computer code that drives this software miracle is most certainly one of the world's less appreciated wonders. Of course Turbo Tax is a suspected victim of the recent Heartbleed encryption computer code virus (Have no fear, I have changed my password!). This means that ostensibly there could be a computer hacker attempting to file a return in my name but I am pretty sure any refund filing submitted would result in an automatically rejected transmission to the IRS system with a display something like this "Error 404: Lucy Waterbury does not receive refunds from the IRS. Please try resubmitting your return, this time with some cash behind it. That is all". They may not have a single person in the place who understands their own code they are enforcing, but they do understand that Lucy Waterbury never gets refunds.

This brings me to my next point. Evidently the IRS is in a bit of a bind this year when it comes to answering their own phone. According to an AP article "Risk of audit by IRS lowest in years" written by Stephen Ohlemacher, as published on the front page of today's Lexington Herald-Leader, "Last year, only 61 percent of taxpayers calling the IRS for help got it." Okay this blows my mind, who calls the IRS to ask them for tax guidance?! How does that phone conversation (assuming they answer!) go exactly? Maybe something like this....

------------------------------------------------------------------------------------------------------------

(phone ringing heard in the background....)

(call answered with recorded message "Your call may be recorded for training purposes", but not "quality assurance" because really, the government doesn't care about that!)

-"Hi, is this the IRS?"

-"Yes, this is Cheryl, an IRS tax adviser, how may I assist you?"

-"Here's the thing, I am a self-employed business man & I bought myself a houseboat to use on Lake Cumberland last year so I could entertain clients and write it off as a deduction even though I will be the one really using it with not a client setting foot on that beauty. So anyway, how do I calculate the mileage on Lake Cumberland to take the mileage deduction for this bad boy or do I have to depreciate the damn thing?"

-"(silence briefly ensues) Well sir, it is a difficult question for me to answer, as you basically just asked me how to take an illegal tax deduction, but since you called from your personal cell and we have a souped-up, NSA programmed, caller ID program that links directly to your tax filing records, I'm going to wonder why you called your government to ask that question." (for the record, I have no idea if this is true but given what the NSA is monitoring these days, it seems logical to me that this could be the case)

-"Okay, I will just tell the missus we need to leave the boat in the slip this year and party like it's 1999 with the other Ohio Navy sailors who never take their house barges out. Oh and miss, you should really come down to Cumberland this year, they are putting all the water back in and it's going to be good times down there in the Bluegrass!"

-"Thank you for the tip sir, have a lovely evening."

(click)

------------------------------------------------------------------------------------------------------------

Please note: If your taxes are so complicated that neither you nor Turbo Tax can figure them out, you need a CPA folks. Don't call the IRS.

To make matters worse, the self-reporting nature of our tax code, makes those of us that are self-employed dig deep to find the center of their moral compass at tax time. Elizabeth Maresca, who is a former IRS lawyer turned academician, is also quoted in the article. According to Maresca, "Anybody who's an employee, who gets paid by an employer, has a limited ability to take risks on their returns...I think people who own their own business or are self-employed have a much greater opportunity (to cheat), and I think the IRS knows that too." Ya think?!

The article also states, "the IRS could scrutinize more returns -- and collect billions more in revenue -- with more resources....the IRS would collect $6 for every $1 increase in the agency's enforcement budget." Evidently Congress has no appetite for fully funding the IRS to get a return of six times their investment. And this my friends, along with an inordinately complex tax code, is what is wrong with the government today; passing new and complex laws that no one truly understands and while not enforcing the ones we have on the books already. I don't care what your politics are, I think we can agree on this point.

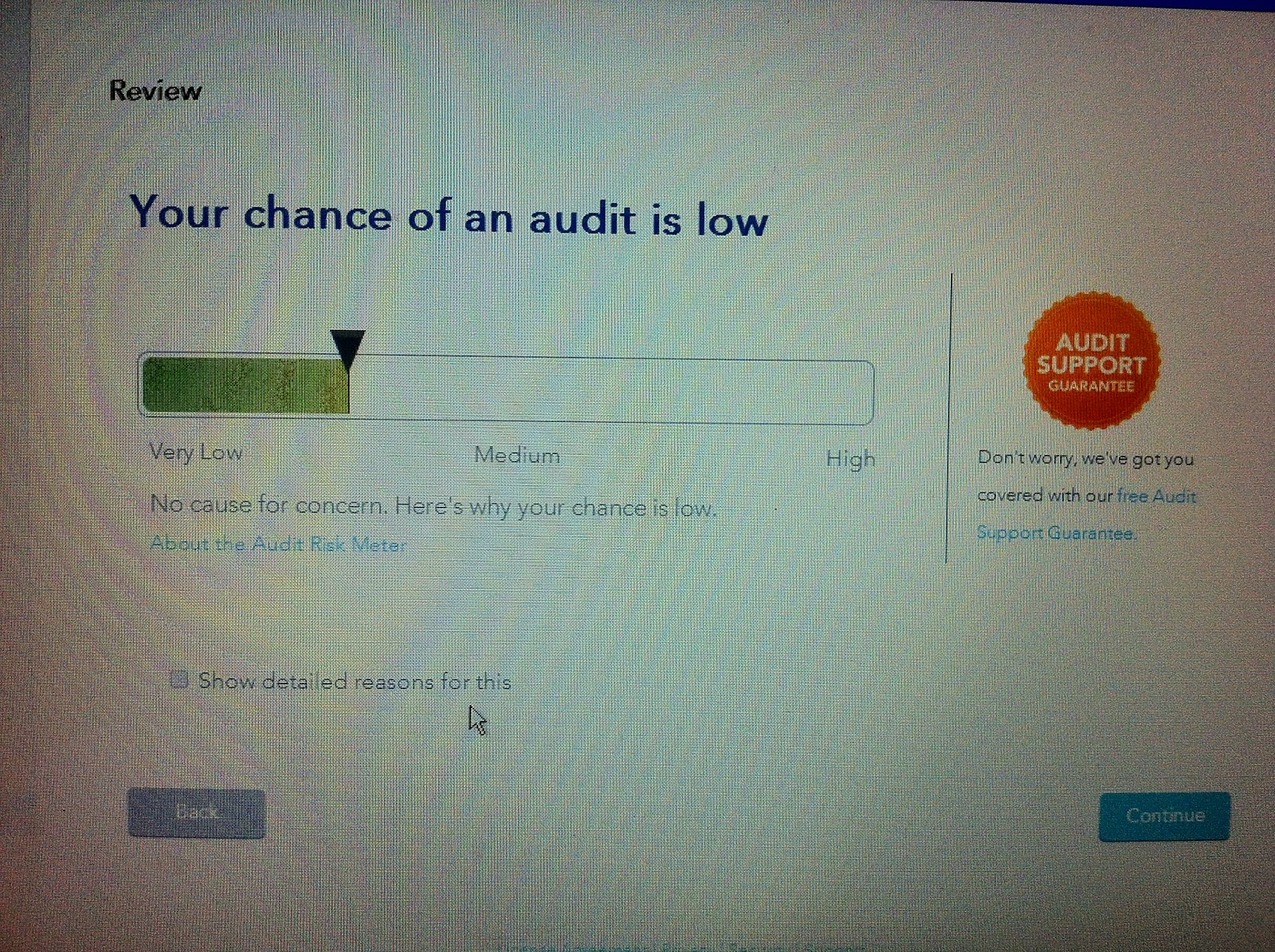

My husband and I are both self-employed. I do not cheat on my taxes, as lying isn't in my repertoire, and I am in favor of liking the person who stares back in that mirror every morning. According to the Turbo Tax algorithm, my chances of getting audited are low. But on this eve of the 2014 tax filing deadline, just hours after emptying my bank account to fulfill my complex tax burden, I will gladly accept this uncertainty of a potential audit over the other certain thing in this life.

So true!

ReplyDelete